The World Federation of Diamond Bourses (WFDB) Presidents Meeting after a special session on blockchain technology and supply source traceability has decided to take further steps on the need for increased transparency in diamond transactions.

The decision came after a debate on the conclusions of a panel on traceability, provenance and blockchain technology which included De Beers Group’s Feriel Zerouki, NAMDIA’s Kennedy Hemutenya, London Diamond Bourse President Alan Cohen, Alrosa’s Head of International Relations Peter Karachiev, James Bernard, Director of Sales for the DMCC and Iris Van Der Veken, Executive Director of the Responsible Jewellery Council moderated by Peter Meeus, Honorary Chairman of the Dubai Diamond Exchange.

Ernie Blom, WFDB President, said: “the fragmented nature of the industry means that there is a dearth of information available about the gems and jewellery companies. Recent frauds, perpetrated by a few rotten apples, have also made banks and financial institutions mistrust the industry. They have also been demanding more transparency within the industry.

“As part of its compliance towards AML, each stakeholder in the industry is required to do and maintain a proper CDD (this is typically also known as Know Your Customer (KYC) or Know Your Supplier, or Know Your Counterparty) for each of its Customers and Suppliers with adequate supporting documents and regular updates to the information.”

On an average, 80% of information in any KYC is common. If 10 member establishments are selling to the same customer and they each maintain their own separate individual KYC for that Customer, then their customer will have to fill 10 KYC Forms, most of which will repeat information (80-90%) and unique information (10-20%).

The diamond trade is traditionally a B2B segment with the bulk of transactions between a given set of customers. It is estimated that a diamond changes hands 7-8 times before it is finally sold to the consumer.

“For the WFDB, this makes the need for a common platform even more pressing, so as to bring about more transparency in the industry,” Blom argued.

At the panel discussion on this subject, it became abundantly clear that consumers do care about what they are buying, and they want to be assured that their purchase is making a positive contribution and that diamond companies should be providing those assurances.

Blom further explained: “as 98% of all diamonds sold are below 7 pts., this technological revolution will not come overnight. From the midstream which is the World Federation of Diamond Bourses with its 30,000 members worldwide, this new development comes at a difficult time.”

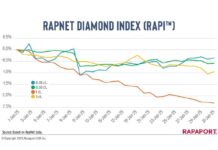

At a moment that credit is squeezed, profit non-existing, rough and polished prices downward, there is little money for marketing and sustainability projects.

Alan Cohen, President of the London Diamond Bourse who was a participant in the panel, said: “there is no miracle formula to counter the changes that are on the way. It will be a choice between jumping on the train or missing it. We must embrace the new technologies.”

“The WFDB has accepted and embraced the fact that Blockchain is here to stay, but it has to be practical and available to each and every member who wants it, not just a select few. The WFDB has decided to reach out to a shortlist of Blockchain experts to assist in the development,” Blom concluded.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.