Gold jewellery exports that have dropped by 6 per cent in the first 8 months of FY18 may take a further knock as UAE, one of the major buyers of Indian jewellery, will impose 5 per cent VAT from January 1, making jewellery costlier for shoppers.

“Exports to the UAE have already dwindled after the government imposed 5 per cent customs duty on gold from the beginning of the year. Now the UAE government will be introducing 5 per cent VAT which will further affect sales. More than half of plain gold jewellery manufactured in India is exported to the UAE,” Praveen Shankar Pandya, chairman, Gem & Jewellery Export Promotion Council, told ET.

The industry executives said that VAT on gold and diamond jewellery comes into effect at a time when shoppers across the globe are flocking to Dubai to participate in the Dubai Shopping Festival that kicked off from Tuesday, and will go on till January 27.

Pandya said that there’s no clarity on whether VAT will be charged on gold jewellery that will be re-exported from Dubai to other parts of the world or not. A lot of Indian jewellery is routed through Dubai to the global markets. “We are waiting for more clarity from Dubai this week,” he said.

According to GJEPC figures, exports of gold jewellery has come down by 6 per cent to Rs 14733.83 crore in the first 8 months of FY18.

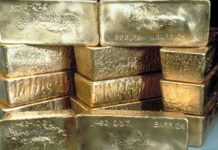

Industry executives said that all gold jewellery purchases in Dubai have been assigned the 5 per cent VAT, while there’s no VAT on 24 carat gold in the form of bars. As per VAT guidelines, anything with 99per cent gold purity and in a tradable form in international markets will not carry any VAT. The executives said that it is still not clear whether gold coins will have 5per cent VAT or not.

News Source: indiatimes

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.