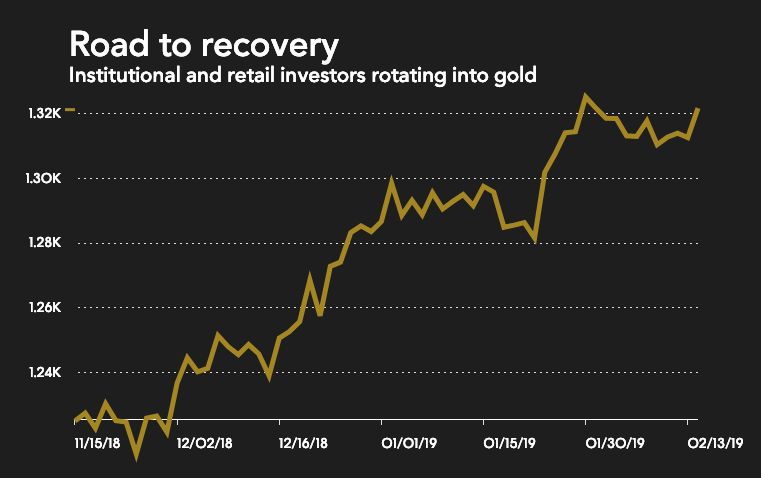

The results of the survey by the London Bullion Market Association of analysts’ predictions for the gold price in 2019 is another example of just how unpredictable financial markets have become.

The LBMA, a standards setting body for the industry, says the average forecast by the 30 analysts polled calls for a modest 1.8% gain in the price this year. However, two-thirds of the analysts see gold reaching or surpassing the $1,400 mark at some point during the year.

Individual views of the direction of the gold price all over the place with a trading range of $325 per ounce or a full 25% of the average forecast price:

“Whilst markets have factored in some of the downside risks of Brexit and US-China trade wars, other factors such the level of US real interest rates, strength/weakness of the dollar, the likely impact of geopolitical factors and the pace of global economic growth continues to provide some uncertainty.”

Eddie Nagao of Sumitomo in Tokyo is the most bullish, forecasting a high of $1,475 saying gold is likely to be one of the favoured asset classes among institutional and private investors as the likelihood of a US recession increases.

Only six analysts predict an average for the year below $1,300 with Adam Williams of Fastmarkets MB (Metal Bulletin) the most bearish. Williams predicts a high for gold of $1,355 a dip to below $1,200 and an average of $1,242:

“With a US/China trade deal expected before too long, a return to more broad-based growth may well come to the rescue. If so, demand for haven assets may diminish. Gold was a bolthole for investors in the second half of 2018, but a return to more concerted growth should mean that prices will start to drift lower again in 2019, especially if the Fed’s more dovish stance proves short-lived.”

Ross Norman of Sharps Pixley, London’s top bullion broker, forecasts a tight range for gold; $1,280 on the downside, a $1,410 high and $1,337 average. Norman has been the most accurate forecaster in recent years coming in as the outright winner five times and a runner up four times.

The winner of the 2015 competition who came within $1 of that year’s average, Bernard Dahdah of French investment bank Natixis, is more bullish about gold’s prospects in 2019 than in previous years, forecasting an average of $1,330.

Gold ended Monday in New York on Friday bang on Dahdah’s forecast average for the year of $1,330.

Parabolic palladium?

Silver is forecast to increase by over 4% in 2019 to average $16.28 an ounce. The range of forecasts include a low of $12.25 and a high of $20 for the metal which has lagged gold’s performance in recent years and may be ripe for a rerating.

Forecasters are most bullish about the prospects for platinum which is predicted to add more than 5% on average after the precious metal fell to multi-year lows last year. Platinum last traded at $808 an ounce in New York.

High-flying palladium will ease back to $1,267 during the year, but even more than gold, the palladium market has become very difficult to read.

Predictions range from a low of $900 to a high of $1,715. The latter is Norman’s view of the palladium price adding that the metal used in autocatalysts “has the capacity to surprise even further to the upside, especially if the supply deficit attracts speculators. More so, if the political risk from its biggest producer, Russia, becomes inflamed.”

Palladium on Monday exchanged hands at $1,433, a fresh record high.

NewsSource: mining

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.