Diamond prices declined for higher clarities in February following a positive trend in the previous month, Rapaport Group said in a press release. Demand for SI qualities improved.

The US and other Group of Seven (G7) members introduced a ban on “Russian Source” diamonds of 1 carat and larger, even if they were manufactured in a third country. The US is requiring self-certification as an enforcement method but only announced this on 29th February, the day before the rules went into effect.

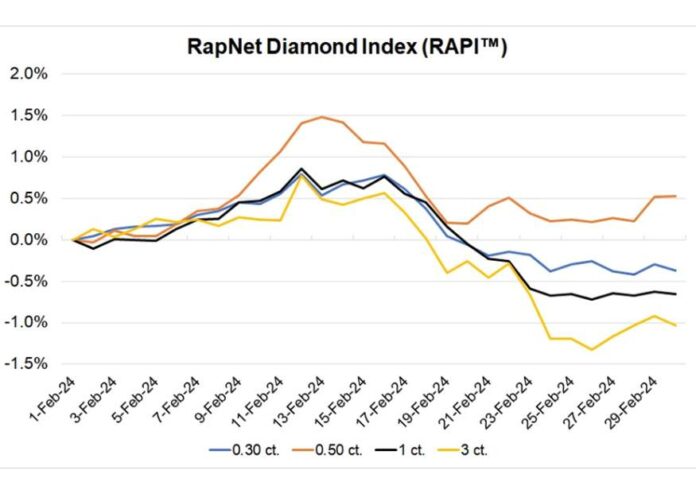

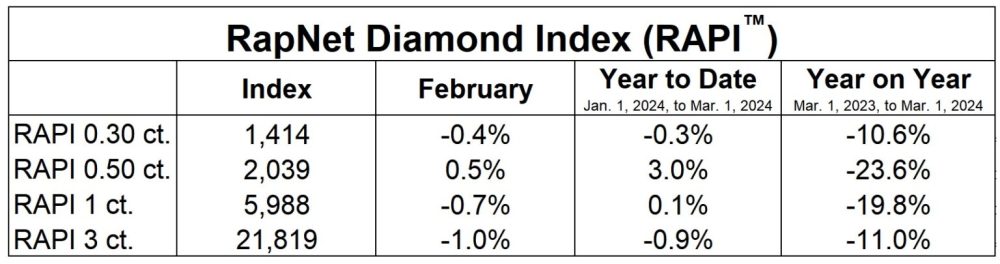

The RapNet Diamond Index (RAPI™) rose in the first half of the month before weakening in the second half. RAPI for 1-carat diamonds — reflecting round, D to H, IF to VS2 goods — declined 0.7% in February. RAPI for 0.30 carats fell 0.4%, and 3-carat goods dropped 1%. The 0.50-carat RAPI gained 0.5% despite slipping in those last two weeks.

Rapaport said lower clarities performed better, with good demand for round, 0.50-, 1- and 2-carat, D to H, SI1 to SI2, RapSpec A3+ diamonds. VVS diamonds were slow. Melee continued to sell well.

Rough prices were stable at De Beers’ February sight. Sightholders showed solid demand for additional “ex-plan” goods following January’s price drop.

US jewellers had a mixed Valentine’s Day, with a bump in orders for heart shapes, it informed. American dealers were reluctant to buy for inventory, as the retail sector was in a seasonal slowdown after the holidays.

Rapaport informed that traffic and sales at the Hong Kong shows were sluggish, as Chinese demand has declined. Mainland consumers seeking investments are showing more interest in gold than in diamonds. Domestic Indian demand continued to support the market for higher-quality goods under 1 carat, but the wedding season will end soon. This has increased the US’s importance to the global diamond industry this year.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.