Stepping into the glittering world of diamond investment requires more than just an appreciation for the beauty of these glittering gems. It’s about understanding their intrinsic value, navigating the complexities of the market, and making informed decisions that align with your financial goals. This guide delves into the essential facets of diamond investing, from mastering the fundamentals of cut, color, clarity, and carat, to the nuances of market trends, ethical sourcing, and online shopping strategies. Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer captivated by the allure of diamonds, this article sheds light on what every buyer should know to make savvy investment choices. Let’s unveil the sparkling world of diamond investing, where brilliance meets financial acumen.

The Basics of Diamond Investing

Real diamond investing starts with mastering the basics: the 4 Cs—Cut, Color, Clarity, and Carat Weight—form the cornerstone of understanding a diamond’s value and appeal. Each C plays a pivotal role in a diamond’s story, from the precision of its cut, which defines its brilliance and fire, to the purity of its color, clarity of its appearance, and weight measured in carats. Equally critical is the diamond’s certification, which verifies these attributes through rigorous assessment by reputable gemological laboratories. This certification not only ensures the diamond’s quality and underpins its investment potential, providing a transparent foundation for making informed decisions in the vibrant world of diamond investing.

How Diamond Market Works

The diamond market requires a keen understanding of the nuances influencing pricing and market value. Pricing trends fluctuate based on many factors, including economic conditions, rarity, and consumer demand, painting a complex picture of the market’s dynamics. Distinguishing between retail and investment-grade diamonds is essential; while the former caters to consumer jewelry preferences, the latter are selected based on stringent criteria for long-term value appreciation. Investment-grade diamonds are often rarer and possess qualities that are highly sought after in the market, making them a distinct category with their unique market behavior. By comprehending these elements, investors can make more strategic decisions when delving into the diamond market.

The Process of Selecting Investment Diamonds

Selecting diamonds for investment goes beyond the basic criteria of beauty and brilliance; it involves a meticulous evaluation of a diamond’s potential for value appreciation. Key to this assessment is understanding the provenance of the diamond—knowing exactly where it comes from, its journey from mine to market, and ensuring it has been ethically sourced. This transparency ensures the diamond’s value is preserved and aligns investment choices with ethical considerations, an increasingly important factor for investors today. Ethical sourcing directly impacts a diamond’s desirability and market value, as conscientious diamonds carry a premium not just in monetary terms but also in contributing to responsible jewelry practices.

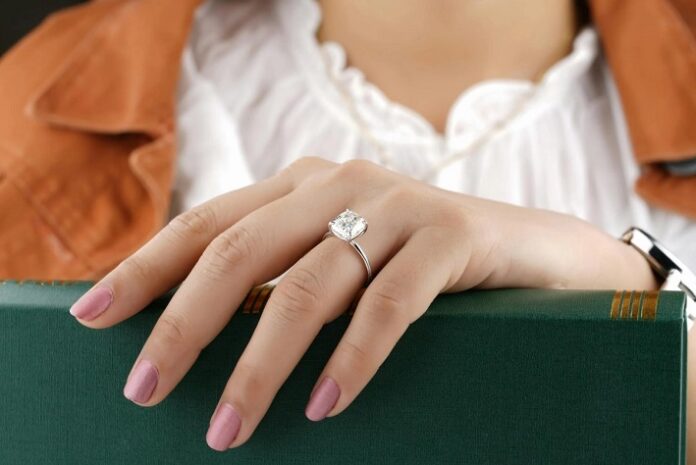

Online Diamond Shopping: A Modern Approach

The world of online diamond shopping offers investors a modern and convenient way to expand their portfolios. This digital approach provides access to a global market, where comparing prices and verifying authenticity becomes more accessible and efficient. For instance, considering a 5-carat lab diamond can provide both value and ethical benefits, making it an attractive option for discerning investors. When looking to shop diamonds online, especially for investment pieces, it’s crucial to prioritize safety by researching reputable platforms that offer certification and detailed product information. Online reviews and secure payment options are also key indicators of a trustworthy site. This method broadens the selection of investment-grade diamonds and empowers investors with the knowledge and tools needed to make informed decisions from the comfort of their homes.

Financial Considerations

Navigating the financial aspects of diamond investment involves careful budgeting and understanding the gems’ resale value and liquidity. Investors should research market trends to make informed decisions, ensuring their investment aligns with long-term financial goals. Patience and strategic planning are essential, as diamonds may take time to appreciate.

Legal and Ethical Considerations

Exploring the ethical landscape of diamond investment reveals crucial considerations like the Kimberly Process, which aims to prevent the trade in conflict diamonds. Investors are increasingly mindful of the environmental footprint of diamond mining and prioritize ethical sourcing practices. Lab-grown diamonds emerge as a sustainable alternative, offering a responsible choice without compromising quality or beauty. Embracing these ethical dimensions ensures your investment contributes positively to global efforts against environmental damage and unethical practices.

Conclusion

In wrapping up our exploration of diamond investment, it’s clear that the journey is as multifaceted as the gems themselves. From understanding the 4 Cs to navigating the online marketplace and recognizing the importance of ethical considerations, each step is crucial in making an informed decision. As you venture into this sparkling world, let diligence and expert advice guide you. The beauty and potential of diamonds as an investment are undeniable, but they demand a keen eye and a responsible approach. Whether you’re drawn to the allure of traditional stones or the appeal of lab-grown alternatives, remember that knowledge is as valuable as the diamonds themselves. Dive into research, seek expert opinions, and may your diamond investment journey be as brilliant and enduring as the gems you choose to invest in.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.