Pic & Article courtesy: FCRF– The COVID-19 pandemic brought with it unprecedented chaos. Angry mobs looting Fifth Avenue stores and a complete lack of clear governmental policy has left many high-net-worth individuals with a feeling of uncertainty, tempting investors to seek out portable forms of wealth. During this period of upheaval, and in light of the attention the Fancy Color Diamond Index received from the international financial community, we were asked to paint a general background on this asset class and answer members’ many questions about the investment perspective of these rare gems.

“What are the benefits of investing in Fancy Color Diamonds in comparison to other luxurious collectibles?” Which platform enables short-term trading for these natural diamonds? “How does this alternative investment category behave in times of crisis?” “What are the pros and cons compared to other investments?” and “What would be the right investment approach without overpromising results?”

During this past year we have compiled our answers and up-to-date market analysis into this readily available report for the benefit of our members from the financial sector.

The combination of the words “Fancy Color Diamonds” and “investment” is quite common outside the wholesale market, with many referring to Fancy Color Diamonds as “an alternative investment vehicle.” Because there is no clear investment practice for Fancy Color Diamonds and no transparency regarding margins or inventory time cycles, sprouting “investment agents” in this category tend to introduce many investment terms that are sometimes confusing, inaccurate and unrealistic.

An important but incorrect belief that needs to be refuted is the premise that Fancy Color auction results can be used as a reference for a generic pricing database. In most cases, Fancy Color Diamonds offered for sale at auctions are stones that were rejected by professional dealers due to typical quality flaws that make these diamonds “a hard sell.” Diamonds at auction represent a very small and inconsistent sample of the diamonds in the market. In fact, the vast majority of Fancy Color Diamonds outside the auction are of much higher quality and are mostly sold by retailers for higher prices. Following the COVID-19 events and the renewed need by various investment agents to explore investing in Fancy Color Diamonds, we decided to review a few industry fundamentals with the hope that we can crystallize the differences among the various investment options and calibrate investor expectations accordingly.

Background

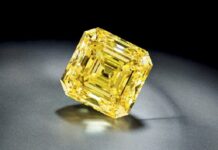

During the 1960s and 1970s, people who owned a large jewelry collection but were still on the lookout for unattainable gems, gravitated towards Fancy Color Diamonds, without thinking of them as investments. During those years, Color Diamonds simply became a symbol of exotic yet refined taste. Today’s collectors wear multimillion-dollar Fancy Color jewelry as a way of saying who they are without having to speak.

Generally speaking, investing in Fancy Color Diamonds can be profitable, yet doing so is not a trivial task. Hence, investors need to calibrate their expectations regarding the maturity timeline of this investment, expected margins, and the platform through which they will later liquidate these diamonds — if needed.

The notion that Fancy Color Diamonds could be a personal investment emerged in the 1990s, right after buyers noted sharp price increases in the Fancy Color market. Two decades later, after the world had recovered from the subprime meltdown and Fancy Color prices had shown that they could outperform alternative asset classes, the investment community started showing interest in these gems and some local investment initiatives began to take shape.

In the last few decades, the category of rare Fancy Color Diamonds has constantly increased in price. The Natural Colored Diamond segment is considered to be the least volatile among traditional and alternative asset classes. For example, Blue Fancy Color Diamonds have appreciated by 241% since 2005, while Pink Fancy Color Diamonds have increased by 366%. Incidentally, both categories experienced no significant decreases throughout that period.

Unlike traditional investments that yield income but may fluctuate in value, Fancy Color Diamonds are primarily objects of beauty and passion; they became desirable collectibles among those who realized that Fancy Color Diamonds are a limited resource. As supply is constantly diminishing, new collectors continue to join the club, which enables this exclusive niche to remain stable over the years. A Gerhard Richter painting, a 1963 GTO Ferrari, and a 3-carat Fancy Vivid Pink will not produce an IRR when owned privately; they will nevertheless gradually increase in value or maintain their price. Of all alternative investments, a Fancy Color Diamond has unique benefits that address a long-term, intimate family need, a point we will touch on later.

Behind the Scenes of the Wholesale Ecosystem

The diamond business culture evolved around the notion that a diamond has a unique size-to-value ratio. Therefore, it seemed unnecessary to develop a documented business protocol for an object you can literally pass from hand-to-hand. As diamond trading turned into an industry, today’s markets maintained their “family business” culture and created a closed, legitimate “ecosystem,” based on high morality, absolute trust, and minimal bureaucracy. The fact that governments today allow stones to be delivered to diamond centers door-to-door, with minimal import tax and little bureaucracy, is a sign of confidence. To the surprise of many outsiders, transactions that are of equal value to a residential building are still sealed by saying one Hebrew word — “Mazal” — that simply means “luck.” The business categories included in the first tier are mining companies, diamond manufacturers, wholesale traders, and retailers. Once you become part of this system, you can enjoy the relatively fast movement of goods and generate the moderate profits it allows.

Industry Selling Cycles

To place things in perspective and to coordinate expectations with the various investment approaches, we need to get acquainted with the Fancy Color industry’s sales cycles (especially as most investment platforms claim to have the skills of an experienced industry trader). After conducting a survey among the leading Fancy Color Diamond dealers, we were able to identify various inventory cycles. Their numbers shed light on some investment factors we need to consider.

In the wholesale market, we found three different time cycles for Fancy Color Diamond sales: Fast, Moderate, and Slow.

Fast-moving—Fancy Color Diamonds will be sold at wholesale within three to nine months from the moment a gemological report is issued for the stone.

A Moderate sales cycle will take one to three years.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.