Diamond mining major De Beers reported a decline in revenues in the first half of 2023, amidst the ongoing macro-economic headwinds and a substantial inventory build-up in the midstream.

The company’s total revenue for the six months that ended 30th June 2023 decreased 22% year-on-year to $2.8 billion, with rough diamond sales decreasing 24% to $2.5 billion reflecting the softening in demand.

Total rough diamond sales volumes of 15.3 mn ct were in line with the prior-year period, as a result of a higher proportion of lower value rough diamonds being sold in 2023, it said. This impacted the average realised price in the first half of the year, which decreased by 23% to $163/ct versus $213/ct last year, and reflects the more cautious approach Sightholders took to planning their 2023 allocation schedule due to the uncertain macro-economic outlook, De Beers noted.

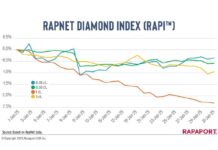

The average rough diamond price index also decreased by 2%, reflecting the overall softening in consumer demand for diamond jewellery and build-up in rough diamond inventory in the midstream.

According to the released figures, De Beers’ H1 rough diamond production slightly dipped marginally to 16.5 mn ct compared to 16.9 mn ct reported in the same period last year. Notably, South Africa saw a significant 59% reduction to 1.2 mn ct in production due to the planned transition to underground operations. However, Botswana and Namibia showed positive trends with an increase of 9% to 12.7 mn ct and 21% to 1.2 mn ct, respectively, in production driven by the planned treatment of higher-grade ore and expansion of mining areas.

With polished diamond inventory levels soaring in the midstream at the start of 2023, demand for rough diamonds took a hit. The anticipated rebound in Chinese demand following the easing of Covid-19 restrictions was thwarted by a fresh wave of infections in the first quarter, dampening consumer confidence. The situation was further exacerbated by softening polished prices and higher financing costs, putting profitability under strain, the company explained.

De Beers said its strong focus on the underlying demand for branded diamond jewellery, especially in key markets like China, continues to show positive growth in bridal and collection segments.

De Beers’ capital expenditure increased by 21% to $302 million, mainly due to investment in the Venetia underground project and ongoing life-extension initiatives.

Looking ahead, De Beers anticipates challenging macro-economic conditions that may impact consumer spending on diamond jewellery. However, its own consumer research affirms the long-term robustness of diamond demand in key markets. “The global supply of rough diamonds is expected to decline owing to limited new discoveries, which in turn is expected to support value growth potential for natural diamonds,” it noted.

As De Beers charts its course for the future, the company also highlighted its plans to enhance diamond provenance through the Tracr™ blockchain platform. This initiative aims to provide consumers with a transparent view of a diamond’s journey, instilling confidence in the authenticity and ethical sourcing of natural diamonds.

The company provided a production guidance of 30-33 mn ct for 2023, and a unit cost guidance of c.$75/ct.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.