De Beers Group, announcing interim results for H1 2018, reported a total revenue of US$ 3.2 billion, “in line” with revenue for the same period of the last year, which amounted to US$ 3.1 billion.

However, the Company reported a decline in underlying EBITDA for the period by 9% to US$ 712 million, as compared to an underlying EBITDA of US$ 786 million for H1 2017. This, De Beers attributed to “unit cost increases driven by the impact of unfavourable exchange rate movements and a higher proportion of waste mining costs having been expensed rather than capitalised, mitigated by higher production”. Further, the Company said EBITDA was also impacted by the lower trading margins experienced in the period.

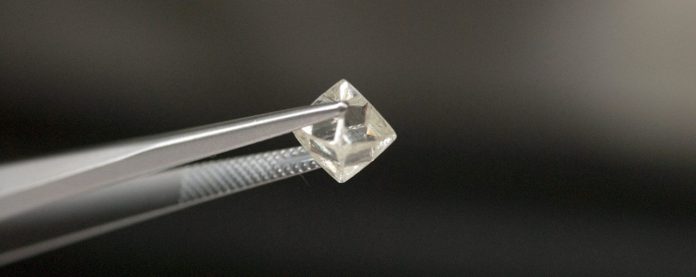

While rough diamond sales were maintained at US$ 2.9 billion, the average rough diamond price realised, increased by 4% to US$ 162/carat as against US$156/carat realised in H1 2017. This was due to “a 1.6% increase in the average rough price index and an improvement in the sales mix, driven by the substantial volumes of lower value goods sold in H1 2017, following the Indian demonetisation programme in late 2016”, the Company elaborated.

If this impact is excluded, the average value of the production mix was lower in H1 2018 “as a higher proportion of lower value carats was delivered from Orapa (Botswana) and GahchoKué (Canada)”. Consolidated sales volumes of 17.8 million carats were 3% lower as compared to 18.4 million carats H1 2017, the Company added.

Other companies of the Group include Element Six, which delivered a revenue in line with the corresponding period last year; and De Beers Jewellers, the results of which have been consolidated following the acquisition in March 2017 of LVMH’s 50% holding.

Commenting on the market scenario, De Beers said that preliminary data indicates a slight improvement in global consumer demand for diamond jewellery, in US dollar terms, compared with the first six months of 2017. “This was driven by growth in the US and China, and was further amplified by positive exchange rate movements in China and Japan against the dollar,” the Company stated. “The Indian market was softer in dollar terms, with prevailing consumer caution, resulting from both macro-economic factors and regulatory changes affecting the jewellery sector.”

The Company said midstream sentiment was positive “on the back of strong demand from the US and China in Q4 2017”, with conditions overall remaining favourable, with midstream inventory within normal levels and a slight strengthening of polished diamond prices since the start of the year.

On the mining front, De Beers’ rough diamond production increased by 8% to 17.5 million carats in H1 2018, as compared with 16.1 million carats produced in the same period of the previous year. This included the contribution from the ramp-up of GahchoKué in Canada; and was “in line with the expected continuation of strong demand”.

In Botswana, Debswana’s production increased by 9% to 12.1 million carats from 11.1 million carats in H1 2017.

In Namibia, Namdeb Holdings saw increase of production by 21% to 1.0 million carats from 0.9 million carats produced in te same period of the previous year.

DBCM in South Africa saw a production decline of 16% to 2.1 million carats from 2.5 million carats produced in H1 2017.

Canada, witnessed production rise by 37% to 2.3 million carats as compared to 1.6 million carats produced in the same period last year, owing to the ramp-up of GahchoKué, which entered commercial production in March 2017, and other factors.

De Beers Group also saw an expansion of its brands. While De Beers Jewellers opened new stores at Xi’an in China and at Kowloon in Hong Kong, and launched new franchise partnerships in Russia and Saudi Arabia; in May, this year it launched a new online store in partnership with Farfetch, the global marketplace for the luxury fashion industry. This has enabled the brand to reach a new audience, throughout 100 countries and via 10 language sites.

De Beers’ diamond brand Forevermark™ is now available in more than 2,300 retail outlets. The brand “celebrated its 10th anniversary, and the introduction of its 1,000th door in China, with the launch of a new retail concept, Libert’aime™ by Forevermark, incorporating an innovative in-store offering with online and social media platforms, specifically focused on targeting Millennials”, the Company said.

A number of new initiatives were also launched in the accounting period. A pilot of the first blockchain technology initiative to span the diamond value chain, is currently underway. “The platform, called Tracr™, will provide a single, tamperproof and permanent digital record for every diamond registered on the platform,” the Company explained. “TracrTM will also underpin confidence in diamonds and the diamond industry by ensuring that all registered diamonds are conflict-free and natural, while also enhancing efficiency across the sector.”

Furher, in April, De Beers announced the launch of GemFair, a pilot programme to create a secure and transparent route to market for ethically sourced artisanal and small-scale mined (ASM) diamonds. “

De Beers also announced the launch of LightboxJewelry (Lightbox), a brand which will sell laboratory-grown diamond jewellery in the US from September 2018. “Lightbox was launched in response to research undertaken by De Beers that demonstrated consumers see laboratory-grown diamonds as fun, fashion products that serve a very different purpose from natural diamonds, and which should be accessibly priced,” the Company said. “As such, Lightbox will provide a completely new offering in the fashion jewellery category.”

“For 2018, forecast diamond production (on a 100% basis, except GahchoKué on an attributable 51% basis) remains unchanged at 34-36 million carats, subject to trading conditions,” the Company stated.

News Source : gjepc.org

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.