A buyer is being sought for Canadian diamond miner Stornoway, after it filed for bankruptcy protection last month.

The company has suspended operations at Renard, the first and only diamond mine in Quebec province, and laid off most of its 500-strong workforce.

Deloitte Corporate Finance Inc. announced today (22 November) that it was conducting the sale and investment solicitation process (SISP) for the sale of Stornoway’s business, property, assets, and undertaking.

“Stornoway is a Canadian diamond mining company whose focus is the operation of its fully owned Renard mine, Quebec’s first and only diamond mine. The Renard Mine is one of only five diamond mines in Canada,” it said in a brief statement.

The deadline to submit a non-binding letter of intent, as requested by the phase 1 bid deadline of the SISP, is 19 January, 2024.

Stornoway, co-founded by Eira Thomas (former Lucara CEO) began commercial production at Renard (pictured) in January 2017. It suffered early problems with diamonds being broken during processing, had to halt operations in March 2020 because of the Covid pandemic and remained closed because of a collapse in diamond prices.

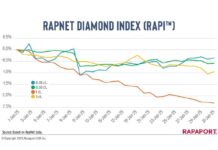

The company cited India’s two-month voluntary ban on rough imports as one reason for its demise, although the latest figures from GJEPC (Gems and Jewellery Export Promotion Council) show a drop from September to October of just 1.4 per cent. The moratorium came into effect on 15 October.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.