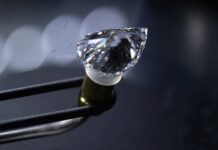

Gitanjali Gems, the company established by Mehul Choksi, the fugitive diamantaire, has been named India’s biggest willful defaulter, with unpaid loans of Rs 7,848 crore ($947m).

The Reserve Bank of India (RBI), has announced a Top 50 of “can pay, won’t pay” borrowers.

Gitanjali once had 4,000 points of sale, and more than a 50 per cent share of India’s overall organized jewelry market.

It closes in 2018 after the Punjab National Bank (PNB) scandal broke, Choksi and his nephew Nirav Modi are suspected of an alleged $1.8 billion fraud against India’s second-largest state lender.

Choksi is currently on the Caribbean island of Dominica, after disappearing in May 2021 from his new home in Antigua, where he took up citizenship. He is fighting moves to extradite him to India to stand trial.

Last month, Modi lost his last-ditch battle against extradition to India, despite arguing he was a suicide risk if he was sent back.

The construction company Era Infra Engineering is second on the RBI list (Rs 5,879 crore, $709m), and Rei Agro, the Basmati rice giant is third (Rs 4,803 crore, $579m),

Seventh on the list is Winsome Diamonds and Jewellery, which was owned by another fugitive Indian diamond merchant, Jatin Mehta (Rs 2,931 crore, $353m).

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.